Is the Venmo Credit Card's New 'Double' Cash Back Offer

The Venmo Blog

The smart Trick of Why is Venmo asking you to verify your identity? That Nobody is Discussing

Products [edit] Users can create an account through a mobile app or website and offer basic info and savings account information. One must have a valid email address and an American cellphone number to use Venmo. Recipients of deals can be discovered through contact number, Venmo username, or e-mail. Users have a Venmo balance that is utilized for their transactions.

Can You Transfer Money From Venmo to PayPal? (2021)

Paying with a bank account or debit card is free, but payments through credit card have a 3% cost for each transaction. Some credit card service providers may charge cash loan costs for Venmo payments. If a user does not have adequate funds in the account when making a deal, it will immediately withdraw the necessary funds from the signed up savings account or card.

4 Easy Facts About Is the Venmo Credit Card's New 'Double' Cash Back Offer Explained

Through Venmo Rewards Program, they can utilize these by bank account transfer or debit card and merchants in-app. When users initially create an account, total transactions can not surpass $299. 99 up until their identity is validated. After their identity has actually been verified, users can send up to $2,999. 99 in each seven day duration.

Like conventional wire transfers, they can take one to 3 service days to end up being last. In January 2018, Pay, Buddy presented an immediate transfer feature on Venmo, permitting users to deposit funds to their debit cards typically within thirty minutes. A cost is deducted from the amount for each transfer; 1% or $10, whichever is less.

FOSI - What Parents Should Know About Venmo

The Best Strategy To Use For Venmo is introducing new fees, and you're not going to like them

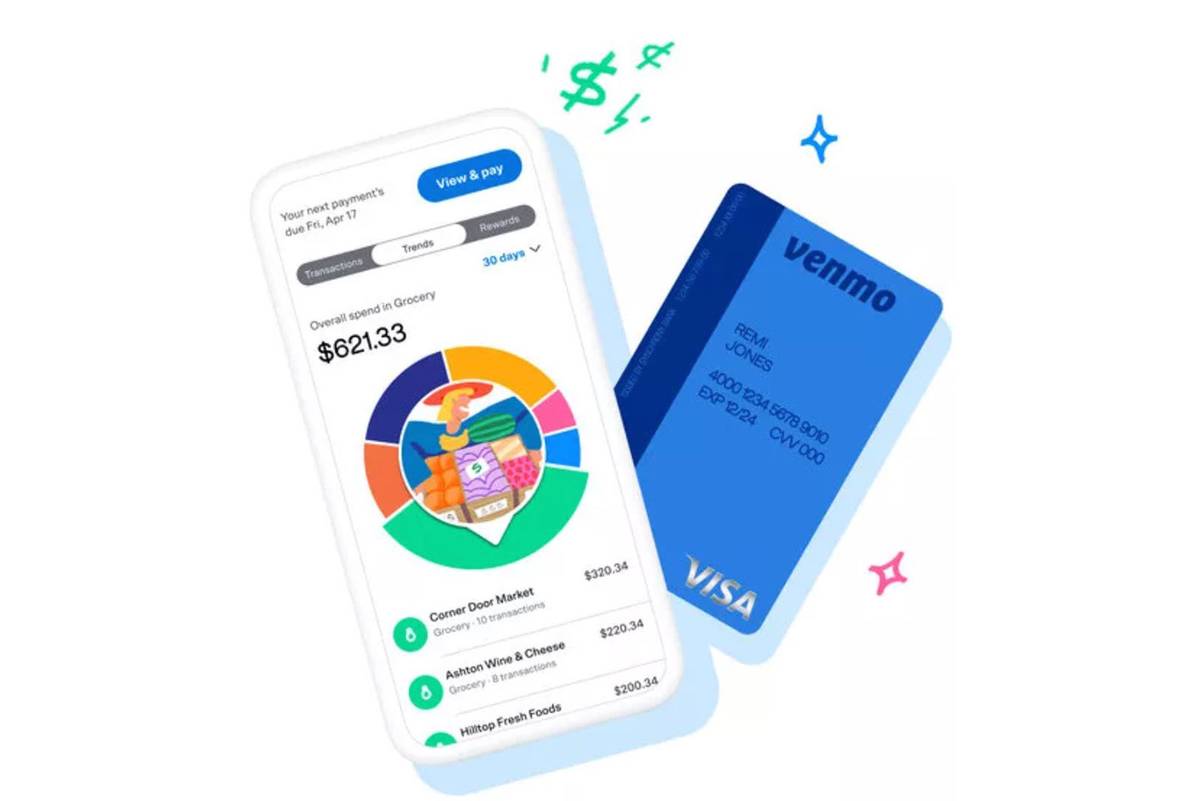

Venmo Master, Card [edit] In 2018, Venmo launched a new physical debit card readily available for users. Reference on the Master, Card network and uses ATM gain access to and overdraft defense. It can be used anywhere that accepts Master, Card, and it enables up to $400 in everyday ATM withdrawals, though deals at non-Money, Pass ATMs feature a minimum of $2.

In addition, the service uses a reload function, which, when enabled, takes money from a user's connected bank account in $10 increments if their Venmo balance drops too low to cover a purchase. Consumers could be based on fees or other repercussions from their bank if they overdraft that account.